- Treasurer-Tax Collector

- Property Tax

- Pay Your Taxes

- Property Tax

- Overview Of Property Taxes

- Tax Exemptions, Exclusions, or Savings

- Secured Taxes

- Secured Supplemental Property Tax

- Unsecured Supplemental

- Unsecured

- Delinquent Unsecured Taxes

- Redemption

- Tax Collection FAQ’s

- Mobile Homes

- Change of Mailing Address

- Tract and Parcel Maps

- Servicemembers Civil Relief Act

- Appeal of Property Value

- Related Agencies

- Important Dates

- Auction

- Special Collections

- Unclaimed Property Tax Refunds

- Investments

- Treasury

- Business License

- Transient Occupancy Tax

- Treasurer-Tax Collector

- Property Tax

- Pay Your Taxes

- Property Tax

- Overview Of Property Taxes

- Tax Exemptions, Exclusions, or Savings

- Secured Taxes

- Secured Supplemental Property Tax

- Unsecured Supplemental

- Unsecured

- Delinquent Unsecured Taxes

- Redemption

- Tax Collection FAQ’s

- Mobile Homes

- Change of Mailing Address

- Tract and Parcel Maps

- Servicemembers Civil Relief Act

- Appeal of Property Value

- Related Agencies

- Important Dates

- Auction

- Special Collections

- Unclaimed Property Tax Refunds

- Investments

- Treasury

- Business License

- Transient Occupancy Tax

FAQs

Taxes that are assessed against real property (land, structures, etc.).

The secured tax statements are usually mailed by October 15 of each year.

Secured Property Tax 1st Installment is due November 1st, delinquent after December 10th. 2nd Installment is due February 1st, delinquent after April 10th. A penalty of 10% of installment amount will be added after each delinquent date + additional $30 cost fee after the April 10th delinquent date. When December 10th or April 10th falls on a Saturday, Sunday or legal holiday, the delinquency date is the next business day.

The first installment covers July 1st to December 31st. The second installment covers January 1st to June 30th. This is considered a fiscal year and is the reason the statement will show two years, i.e., 16/17 or 17/18.

If your taxes are paid through an impound account (i.e., included with your mortgage payment), you will receive a copy tax statement. Your lender will also receive the statement. Supplemental taxes, however, are not sent to your lender, but are mailed directly to you. It is your responsibility to contact your lender to determine who will pay the supplemental tax.

Please call the Ventura County Tax Collector’s Office, 805-654-3744, Mon – Fri. 8:00AM -12:00PM and 1:00PM-4:30PM, or email HelpingHand@Ventura.org to request a statement. You may also download a copy of the statement from our website: https://prop-tax.countyofventura.org/.

Yes, you may pay for multiple parcels and/or installments with one check.

Effective January 4, 2023:

There is a service/convenience fee for credit and debit card usage:

* 2.75% of the total transaction amount for Credit Cards

* 1.75% of the total transaction amount for Debit Cards

The current fee for using your checking account to make a payment online is $1.10, regardless of the amount of your payment.

These service/convenient fees are set and collected by the 3rd party processing company. Ventura County does not receive any of the service/convenience fees the 3rd party vendor collects.

No. The online payment system does not have the ability to use more than one account per transaction and only full installments are payable. The online payment system will not allow for partial credit card payments.

No. We only accept payments for the full installment amounts. If late payment penalties are applied they must also be included for your payment to be accepted.

You may obtain a form from the Ventura County Assessor’s office for a formal appeal of your assessed property value: https://ventura.org/assessment-appeals . For more information contact the Ventura County Assessor’s office at (805)654-2181

No. For a list of exemptions and qualifications please contact Ventura County Assessor’s office at (805)654-2181 or visit their website: https://assessor.countyofventura.org/

The California State Controller’s office also offers a Senior Postponement program. For more information and qualification guidelines, contact the State Controller’s Office at postponement@sco.ca.gov or 1-800-952-5661. Please note that this option is done strictly through the state.

Prop. 60 allows homeowners 55 years of age and older to transfer the base year value of their principal residence to a newly purchased residence in the same county, providing that certain requirements are met.

Prop. 90 allows a homeowner 55 years of age and older to transfer the base year value of their principal residence in one county to a newly purchased residence in another county providing that certain requirements are met. Only a limited number of counties are participating in Proposition 90.

To apply contact the Ventura County Assessor:

Ventura County Assessor

800 S. Victoria Ave Ventura, CA 93009-1270

(805) 654-2181

https://assessor.countyofventura.org

https://www.capropeforms.org/counties/ventura

1. How long will this process take?

The process for each applicant may vary, a generalized time of completion is 9-12 months.

2. Who is involved in the process?

There are three County of Ventura departments involved: the Assessor’s office, Auditor’s office and

Tax Collector’s office.

3. Do I have to pay my tax bill?

Once an applicant has been approved contact our office to verify the transferring value is a

decrease.

4. Will I be penalized?

All approved applicants transferring a lower property value will not be

penalized while the process is being completed.

Prop. 19 allows homeowners 55 years of age and older to transfer the base year value of their principal residence to a newly purchased residence, providing that certain requirements are met.

Due to the volume of payments received during peak periods, it may take the Tax Collector up to 10 business days to process payments received. If it has been more than 15 days since you mailed your check, you should contact the Treasurer and

Tax Collector by calling our office at 805-654-3744, by email at helpinghand@ventura.org, or in person at 800 S. Victoria Ave. Ventura CA 93009-1290.

If the Tax Collector did not receive your original check before the delinquency date, you should review our Avoid Penalties by Understanding Postmarks and our Penalty Cancellation Due to a Lost Payment webpages. If after reviewing this information, you believe your payment is lost, you may complete an Affidavit of Mailing. If it is approved, the Tax Collector will apply your payment without penalties.

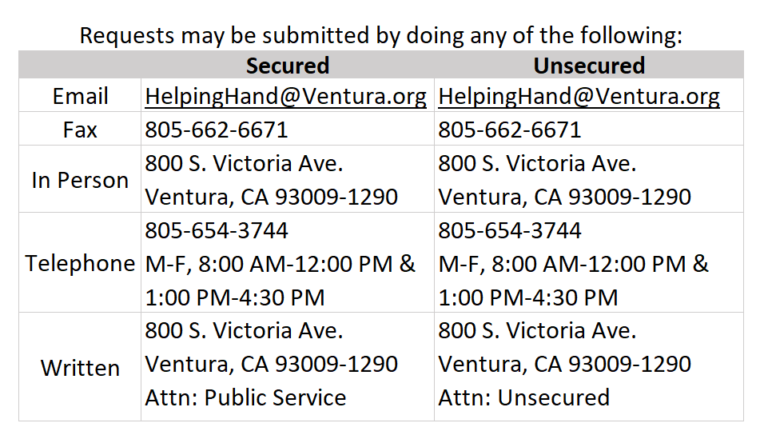

Taxpayers have the right to request a penalty cancellation on secured and unsecured property taxes either verbally, in writing, or by submitting a completed and signed Cancellation of Penalty request form.

Taxpayers who submit a completed Cancellation of Penalty request should receive a response from the Treasurer and Tax Collector within 30 calendar days.

Taxes that have defaulted (also known as in a redemption status) and are no more than 5 years delinquent (3 years for commercial property) are eligible for a 5 Year Payment Plan.

For more information and to check eligibility, please contact our office by calling 805-654-3744, emailing us at HelpingHand@Ventura.org, or visiting our office at 800 S. Victoria Ave, Ventura CA 93009-1290.

1. When may I start a payment plan?

You may start a payment plan after the date on which the property has become tax defaulted (June 30) and within five years of that date (at which time your property becomes subject to the power of sale; and 3 years if the property is commercial).

2. What happens if I fail to pay my delinquent taxes?

Once a tax defaults on June 30th (falls into redemption status), a monthly penalty of 1.5% of the base tax will accrue until payment is made. Taxes may remain unpaid for a maximum of five years following original default date, at which time property becomes subject to Tax Collector Power to Sell.

3. Do you take payments over the phone?

No. Our phone representatives are not authorized to take payments over the phone. Payments may be made in office, online, or by mail.

Standard Accepted Postmarks:

Standard USPS postmarks dated AFTER the statement due date, will be considered late. There are two standard accepted postmarks, one (circular stamped postmark) which is done by the taxpayer handing the postal worker the mail and having it post marked right then, and the standard electronic imprinted postmark for all processed mail found at the top of envelope. The round stamped postmark from a USPS postal worker supersedes the electronic imprinted postmark.

Postmarks Not Accepted:

Metered Mail Postmark aka Pitney Bowes stamped by a machine licensed by the USPS (often used by large private companies), Pre-Canceled Stamps sold through private vendors such as stamps.com, an automated Postal Center (APC) Stamps with, or without a date, purchased from machines located within a USPS lobby.

State law requires the immediate reassessment of property value whenever a change of ownership or completion of construction occurs. If applicable, you will receive a Supplemental Tax bill reflecting the change in value for the balance of the tax year effected. Due dates for a Supplemental Tax Bill are dependent on completion of the reassessment and when a statement is mailed. A decrease in value will result in a refund and do not cause a change to your current annual taxes which must be paid timely to avoid penalty.

New construction is any substantial addition to real property (e.g., adding a new room, pool, or garage) or any substantial alteration that restores a building, room, or other improvement to the equivalent of new (e.g., completely renovating an outdated kitchen) therefore increasing the assessed value of a property.

Change of ownership refers to the sale or transfer of title (whether full or partial) that results in a reassessment of value to current market or purchase value.

For more information and a list of exceptions, please contact the County Assessor, 805-654-2181.

Depending on the time period in which the change of ownership or construction occurred, (i.e., between Jan. 1 and May 31) two Supplemental Tax bills will be created. One for the tax year in which the change or construction occurred for which an assessment was already being collected, and one for the following tax year for which an assessment was set Jan. 1 for which a tax statement is in creation.

If your lender pays your taxes, it is important to note that not all lenders request Supplemental Tax bill information. If you would like your lender to pay the Supplemental Property Tax bill, you should contact them directly. It is ultimately your responsibility to pay the Supplemental Tax bill, which will be mailed directly to you. It typically takes from six months to a year from the date of change or construction for Supplemental Property Tax bill to be created.

You may estimate your Supplemental Tax bill amount by using the Supplemental Tax Calculator. Enter your parcel number or address and click on the link that says Supplemental Tax Calculator. Keep in mind if you purchased your property after January 1, but before June 30, you will receive two Supplemental Property Tax bills because taxes are based on a fiscal year (July 1 through June 30) as of the lien date (January 1).

If you purchase and then sold a property within a short period of time, the Supplemental Tax bill you received covers only those months during which you owned the property, and the new owner will receive a separate Supplemental Tax bill.

Because of the large number of parcels and frequency of properties changing ownership in the County of Ventura, there are often delays in placing new assessments on the roll.

Yes, you will need to pay a prorated amount. Please contact our office by phone, 805-654-3744, email HelpingHand@Ventura.org, or in person at 800 S. Victoria Ave, Ventura CA 93009 to notify us a proration is needed. Once the assessment is prorated an Unsecured Supplemental Tax bill will be issued.