- Treasurer-Tax Collector

- Property Tax

- Pay Your Taxes

- Property Tax

- Overview Of Property Taxes

- Tax Exemptions, Exclusions, or Savings

- Secured Taxes

- Secured Supplemental Property Tax

- Unsecured Supplemental

- Unsecured

- Delinquent Unsecured Taxes

- Redemption

- Tax Collection FAQ’s

- Mobile Homes

- Change of Mailing Address

- Tract and Parcel Maps

- Servicemembers Civil Relief Act

- Appeal of Property Value

- Related Agencies

- Important Dates

- Auction

- Special Collections

- Unclaimed Property Tax Refunds

- Investments

- Treasury

- Business License

- Transient Occupancy Tax

- Treasurer-Tax Collector

- Property Tax

- Pay Your Taxes

- Property Tax

- Overview Of Property Taxes

- Tax Exemptions, Exclusions, or Savings

- Secured Taxes

- Secured Supplemental Property Tax

- Unsecured Supplemental

- Unsecured

- Delinquent Unsecured Taxes

- Redemption

- Tax Collection FAQ’s

- Mobile Homes

- Change of Mailing Address

- Tract and Parcel Maps

- Servicemembers Civil Relief Act

- Appeal of Property Value

- Related Agencies

- Important Dates

- Auction

- Special Collections

- Unclaimed Property Tax Refunds

- Investments

- Treasury

- Business License

- Transient Occupancy Tax

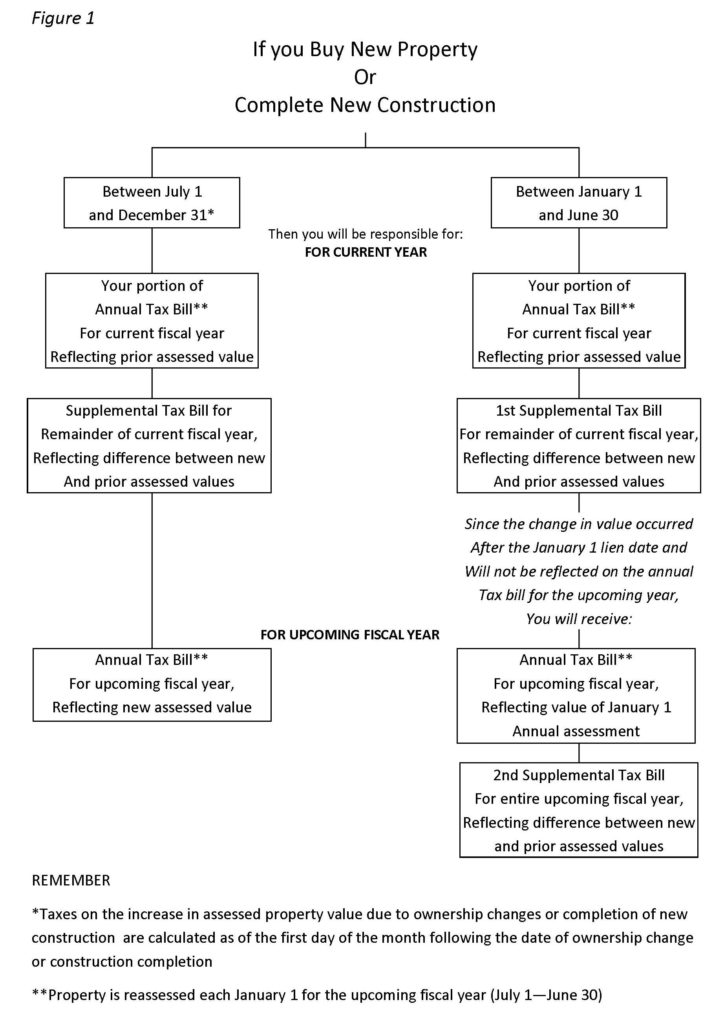

Secured Supplemental Property Tax-Billing Illustration

You are taxed on the supplemental value for the portion of the fiscal year remaining after you purchased the property or completed new construction.

Because the property is assessed each January 1 for the upcoming fiscal year (July 1 – June 30), you will receive one supplemental bill if the change in property value due to ownership change or new construction occurs between June 1 and December 31.

If the change in ownership or completion of new construction occurs between January 1 and June 30, you will receive an additional supplemental bill for the next fiscal year, which will be for the entire fiscal year. (See Figure 1) So it is possible to receive two supplemental tax bills, depending on when the ownership change or completion of new construction occurred and when the Assessor recorded the new value on the tax roll.

If you would like to calculate an estimate for your future supplemental tax bill(s) you may visit our WebTax Inquiry System, enter your Assessor’s Parcel Number (APN) and click on the link for the Supplemental Tax Calculator.

Figure 1 illustrates the homeowner’s obligation to pay both supplemental and annual tax bills after purchasing property or completing new construction. (NOTE: The diagram assumes an increase in property value)