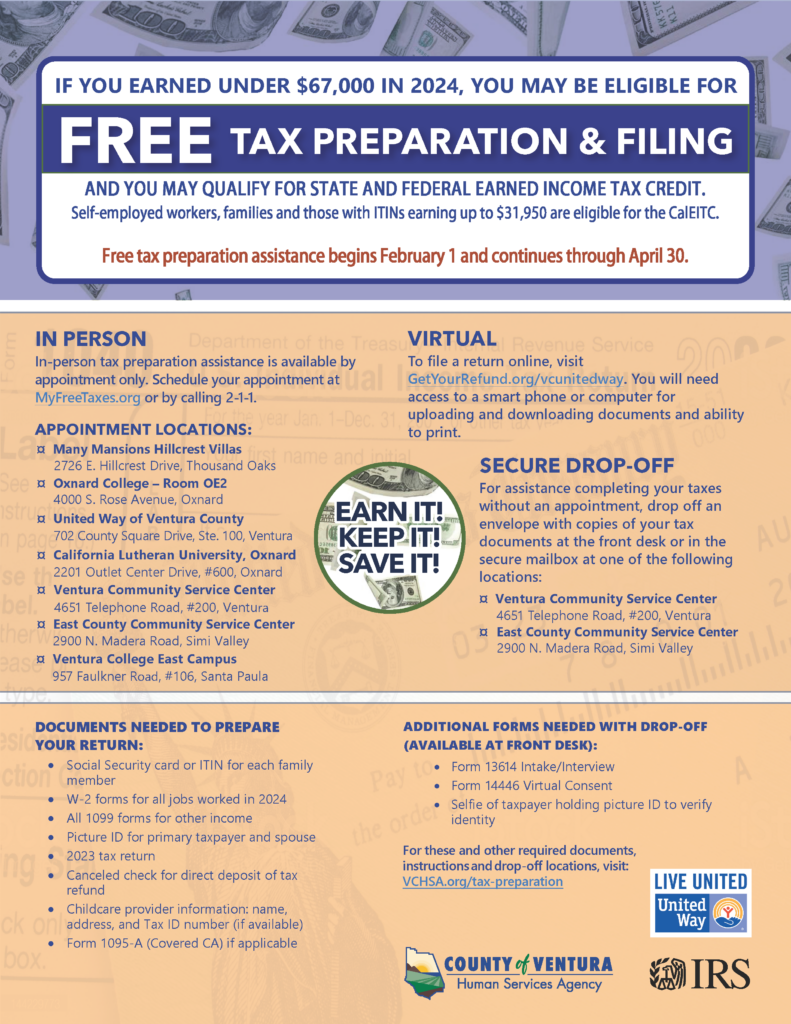

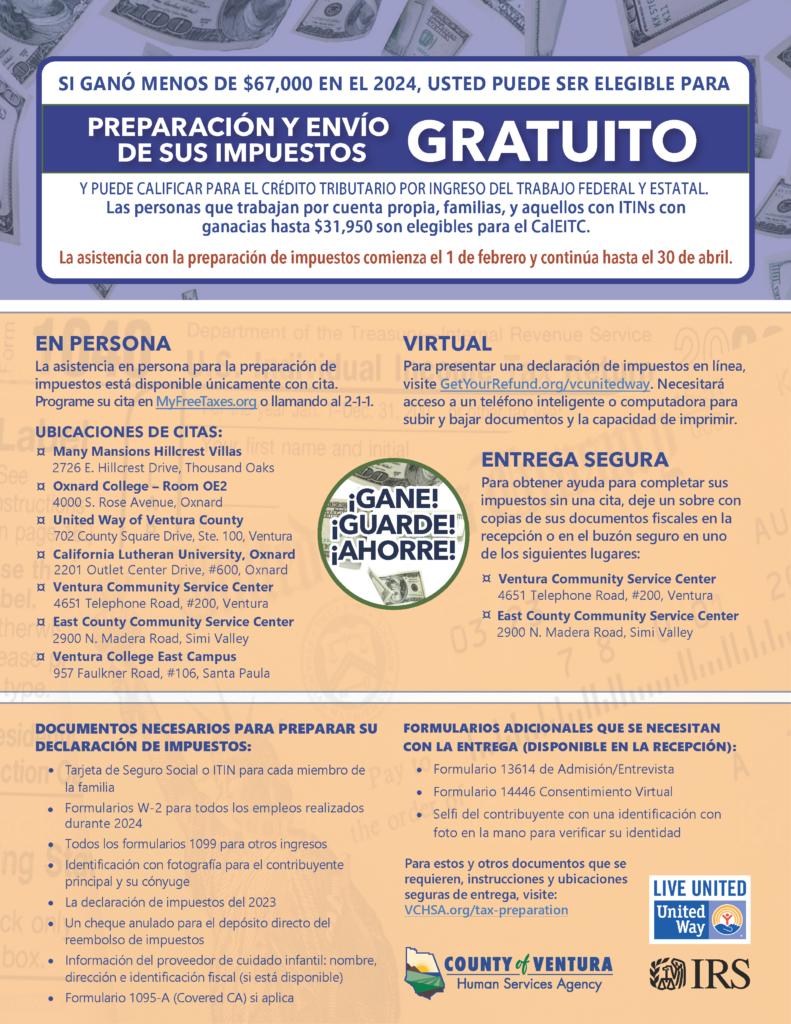

Free Tax Preparation through Volunteer Income Tax Assistance (VITA)

Assistance Available Feb. 1 to April 30, 2025

If you earned under $67,000 in 2024, you may be eligible for free tax preparation and filing, and you may qualify for state and federal earned income tax credit. Tax returns are prepared and filed by trained tax preparation volunteers.

Self-employed workers, families and those with ITINs earning up to $31,950 are eligible for the California Earned Income Tax Credit (CalEITC).

Virtual

United Way MyFreeTaxes allowed taxpayers who were single filers, computer savvy, and with

an e-mail account to file their taxes for free. To file a virtual tax return, go to GetYourRefund.org/VCUnitedWay (en español). You will need access to a smart phone or computer for uploading and downloading documents and ability to print.

Secure Drop-Off

For assistance completing your taxes without an appointment, drop off an envelope with copies of your tax documents at the front desk or in the secure mailbox at one of the following locations:

- Ventura Community Service Center – 4651 Telephone Road, #200, Ventura

- East County Community Service Center – 2900 N. Madera Road, Simi Valley

Additional Forms Needed with Drop-Off (also available at front desk):

- Form 13614-C Intake/Interview (Formulario 13614-C en español)

- Form 14446 Virtual Consent (Formulario 14446 en español)

- Selfie of taxpayer holding picture ID to verify identity

For these and other required documents, instructions and drop-off locations, visit VCUnitedWay.org.

In Person

In-person tax preparation assistance is available by appointment only. Schedule your appointment

at MyFreeTaxes.org or by calling 2-1-1.

Appointment Locations:

- Many Mansions Hillcrest Villas – 2726 E. Hillcrest Drive, Thousand Oaks

- Oxnard College – 4000 S. Rose Ave., Room OE2, Oxnard

- United Way of Ventura County – 702 County Square Drive, Ste. 100, Ventura

- California Lutheran University, Oxnard campus – 2201 Outlet Center Drive, Ste. 600, Oxnard

- Ventura Community Service Center – 4651 Telephone Road, #200, Ventura

- East County Community Service Center – 2900 N. Madera Road, Simi Valley

- Ventura College East Campus – 951 Faulkner Road, Santa Paula

What to Bring to Your Appointment:

- Social Security card or ITIN for each family member

- W-2 forms for all jobs worked in 2024

- All 1099 forms for other income

- Picture ID for primary taxpayer and spouse

- 2023 tax return

- Cancelled check for direct deposit of tax refund

- Childcare provider information: name, address, and Tax ID number (if available)

- Form 1095-A (Covered CA) if applicable

- Form 3895 (Covered CA) if applicable