Ventura County Government Center

Hall of Administration Building, Fourth Floor

800 S. Victoria Ave.

Ventura, CA 93009-1940

CLERK OF THE BOARD OF SUPERVISORS

- Clerk of the Board – Homepage

- Boards and Commissions

- • Agendas, Live Broadcasts, and Meeting Archives

- • Board of Supervisors

- • Air Pollution Control Board

- • Air Pollution Control District Hearing Board

- • Assessment Appeals Board and Hearing Officer

- • City Selection Committee

- • Fire Protection District Board of Appeals

- • Ventura County Consolidated Oversight Board

- • Other County Agency Boards/Commissions/Committees

- Other Services

- • Assessment Appeals

- • File an Assessment Appeal Application Online

- • Submit a Public Records Request

- • Agendas, Live Broadcasts, and Meeting Archives

- • Subscribe to Receive Agenda Notifications

- • File a Claim for Damages Against the County of Ventura

- • Apply for Appointment to a Board, Commission, or Committee

- • File a Form 700 Statement of Economic Interest

- • Service of Summons and Subpoenas

- • Review Conflict of Interest Codes

- • Services and Fee Schedule

- • Forms

- Research Records

- • Agendas, Live Broadcasts, and Meeting Archives

- • Board of Supervisors

- • Submit a Public Records Request

- • Conflict of Interest Codes

- • Form 700 Statement of Economic Interest

- • Board / Commission / Committee Local Appointment List

- • County Ordinance Search

- • County Codified Ordinance Code

- • Air Pollution Control Board Records

- • Air Pollution Control District Hearing Board Records

- • Assessment Appeals Meeting Archives

- • City Selection Committee Meeting Archives

- • Fire Protection District Board of Appeals Meeting Archives

- • Ventura County Consolidated Oversight Board Meeting Archives

- • Archived / Inactive Boards and Commissions

- Contact Information

- Clerk of the Board – Homepage

- Boards and Commissions

- • Agendas, Live Broadcasts, and Meeting Archives

- • Board of Supervisors

- • Air Pollution Control Board

- • Air Pollution Control District Hearing Board

- • Assessment Appeals Board and Hearing Officer

- • City Selection Committee

- • Fire Protection District Board of Appeals

- • Ventura County Consolidated Oversight Board

- • Other County Agency Boards/Commissions/Committees

- Other Services

- • Assessment Appeals

- • File an Assessment Appeal Application Online

- • Submit a Public Records Request

- • Agendas, Live Broadcasts, and Meeting Archives

- • Subscribe to Receive Agenda Notifications

- • File a Claim for Damages Against the County of Ventura

- • Apply for Appointment to a Board, Commission, or Committee

- • File a Form 700 Statement of Economic Interest

- • Service of Summons and Subpoenas

- • Review Conflict of Interest Codes

- • Services and Fee Schedule

- • Forms

- Research Records

- • Agendas, Live Broadcasts, and Meeting Archives

- • Board of Supervisors

- • Submit a Public Records Request

- • Conflict of Interest Codes

- • Form 700 Statement of Economic Interest

- • Board / Commission / Committee Local Appointment List

- • County Ordinance Search

- • County Codified Ordinance Code

- • Air Pollution Control Board Records

- • Air Pollution Control District Hearing Board Records

- • Assessment Appeals Meeting Archives

- • City Selection Committee Meeting Archives

- • Fire Protection District Board of Appeals Meeting Archives

- • Ventura County Consolidated Oversight Board Meeting Archives

- • Archived / Inactive Boards and Commissions

- Contact Information

Prop 8 - Decline in Value, and Prop 13 - Property Tax Limits

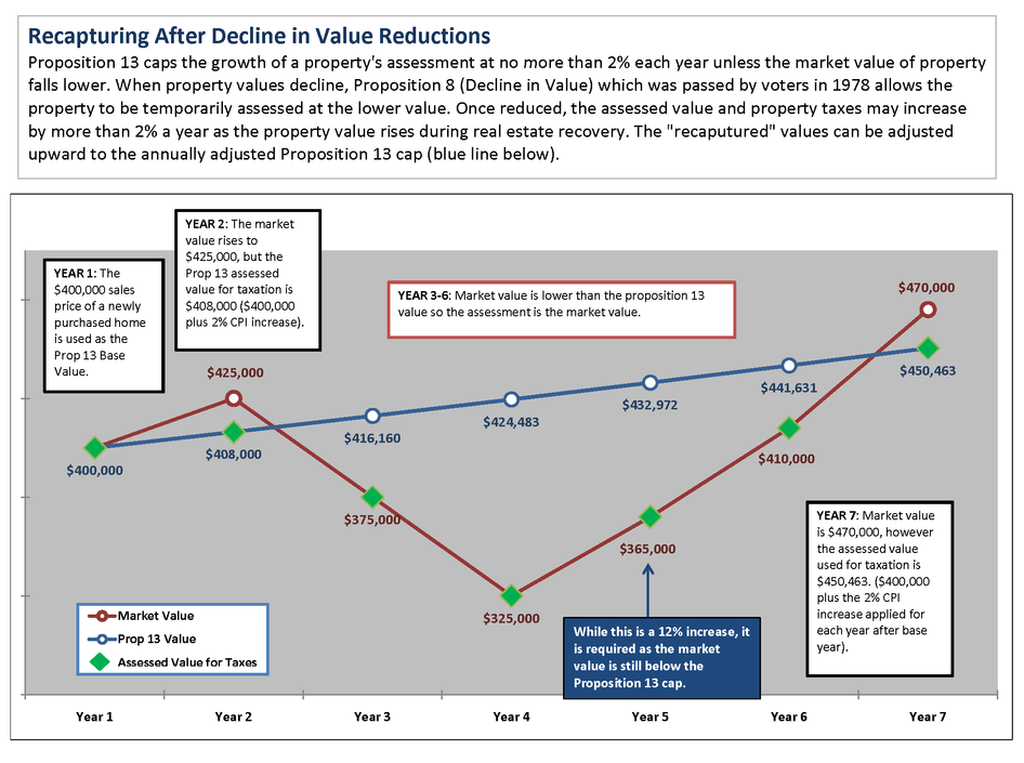

The base year value of real property (land and buildings) is assessed upon change in ownership or completion of new construction on the property. The Assessor’s Office will inform owners of the base value by mailing a “Notice of Supplemental Assessment”. Under Proposition 13 the annual maximum limit that the property can be assessed at is a rate not exceeding 2% for each year, to account for inflation. This means that a properties adjusted base value can go up 6% from the original value over a 3 year period.

In the event that there is a Market downturn, and a property would now sell for less than the adjusted purchase price, the property owner is protected by the Decline in Value law known as Proposition 8. When there is market evidence that the property would sell for significantly less than the value established under Proposition 13, the assessed value can be temporarily reduced to a lower value and is applied on a yearly basis. Values determined under Proposition 8 only apply to one assessment year, therefore when the market begins to recover, the property value can increase more than 2% per year, until it reaches the assessed value limit determined under Proposition 13. The 2% per year value change limit does not apply to assessments made pursuant to Proposition 8, it only applies to the base value set under Proposition 13.

Visual graph explanation of Proposition 8 and Proposition 13:

For more information on how property value is determined,

visit the Assessor’s Office website at https://assessor.countyofventura.org or call them at (805) 654-2181 or read the California State Board of Equalization’s Publication 29 by clicking here.